AI Chip Sales Performance: A Data-Driven Overview of Market Growth, Leaders, and Future Trajectory

AI chip sales have emerged as one of the strongest indicators of technological momentum in the global digital economy. As artificial intelligence moves from experimentation to large-scale deployment, demand for specialized computing hardware has surged. Using estimates from the Epoch AI Chip Sales dataset and corroborating industry research, this article explains how AI chip sales are performing, why growth is accelerating, and what this means for innovation and technology management. Todays article explains current market growth, dominant players, compute capacity trends, and structural drivers shaping the industry. The analysis is grounded in empirical data and framed for decision-makers, technologists, and innovation leaders seeking to understand where AI infrastructure investment is headed.

Table of Contents

- The Market Context for AI Chips

- What the Epoch AI Chip Sales Dataset Measures

- AI Chip Sales Growth and Revenue Trends

- Market Leaders and Competitive Dynamics

- AI Compute Scaling and Its Sales Impact

- Key Demand Drivers Behind AI Chip Sales

- Future Outlook for AI Chip Sales

- Top 5 Frequently Asked Questions

- Final Thoughts

- Resources

The Market Context for AI Chips

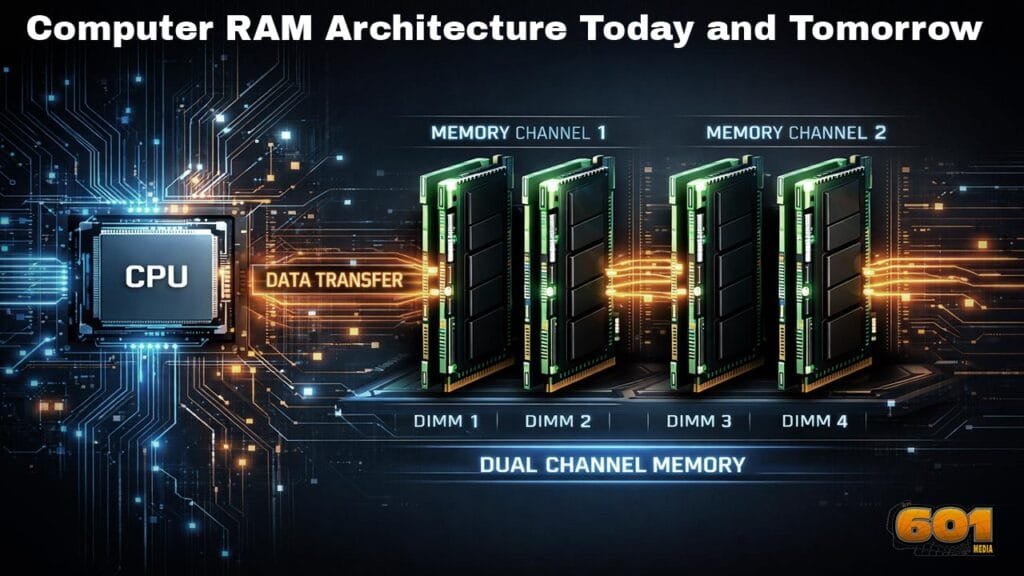

AI chips are processors specifically designed to accelerate artificial intelligence workloads such as training and inference for machine learning models. Unlike general-purpose CPUs, AI chips prioritize parallel processing, high memory bandwidth, and energy efficiency.

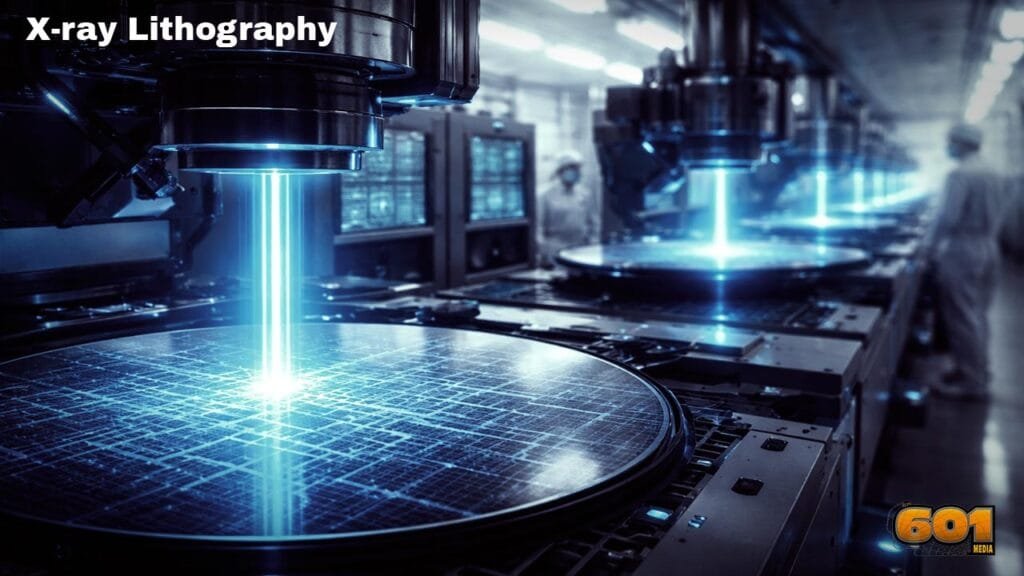

The explosion of generative AI, large language models, and real-time AI services has fundamentally changed computing demand. Organizations are no longer optimizing for occasional AI workloads; instead, they are building persistent AI infrastructure. This shift has transformed AI chips from a niche hardware segment into one of the fastest-growing categories in semiconductors.

What the Epoch AI Chip Sales Dataset Measures

The Epoch AI Chip Sales dataset provides estimates of shipments and compute capacity for dedicated AI accelerators. Rather than focusing solely on revenue, the dataset emphasizes physical deployment and performance-related metrics, including:

- Estimated number of AI chips sold per year

- Aggregate compute capacity delivered

- Power consumption trends

- Approximate cost per unit of compute

This approach is particularly valuable because AI impact scales with compute availability, not just spending. A smaller number of highly capable chips can deliver more AI output than large volumes of older hardware.

AI Chip Sales Growth and Revenue Trends

AI chip sales have shown sustained and accelerating growth over the past several years. Industry research estimates the global AI chip market reached approximately $120 billion in revenue in 2024. This figure reflects both rising unit sales and rapid increases in average selling prices for high-end accelerators.

Several factors explain this performance:

- Advanced AI chips command premium prices due to their performance advantages

- Hyperscale buyers are purchasing chips in massive volumes

- Replacement cycles are shortening as newer chips deliver significant efficiency gains

Market forecasts consistently project strong double-digit annual growth through at least 2030. This trajectory places AI chips among the most strategically important hardware markets globally.

Market Leaders and Competitive Dynamics

The AI chip market is highly concentrated, with one company controlling the majority of high-end accelerator sales. Its dominance stems from a combination of hardware performance, mature software ecosystems, and strong developer adoption.

However, competition is intensifying. Other semiconductor firms and cloud providers are investing heavily in custom AI chips tailored to their own workloads. These alternatives focus on:

- Lower cost per inference

- Energy efficiency at scale

- Tight integration with cloud services

While these competitors currently represent a smaller share of total sales, they are growing faster than the overall market, signaling long-term structural change.

AI Compute Scaling and Its Sales Impact

One of the most important insights from the Epoch dataset is how rapidly total AI compute capacity is increasing. In recent years, deployed AI compute has grown by multiples annually, driven almost entirely by new chip shipments.

This matters because AI capability scales nonlinearly with compute. Larger models and more frequent inference cycles require exponentially more processing power. As a result, AI chip sales are not merely tracking demand—they are enabling it.

For innovation leaders, this creates a feedback loop:

More AI adoption drives more chip sales, which increases compute availability, enabling even more ambitious AI systems.

Key Demand Drivers Behind AI Chip Sales

Several structural forces are sustaining AI chip sales growth:

- First, hyperscale cloud providers are expanding AI data centers globally. These firms purchase chips in volumes unmatched by any other customers.

- Second, enterprise AI adoption is accelerating. Companies across finance, healthcare, manufacturing, and logistics are deploying AI models for production use, not experimentation.

- Third, generative AI applications require constant inference, not occasional batch processing. This dramatically increases hardware utilization and replacement rates.

- Finally, geopolitical and supply-chain considerations are pushing organizations to secure long-term access to AI hardware, leading to advance purchasing and stockpiling behavior.

Future Outlook for AI Chip Sales

Looking ahead, AI chip sales are expected to remain strong, but the nature of growth will evolve. Early expansion was driven by scarcity and performance leaps. Future growth will increasingly depend on efficiency, specialization, and total cost of ownership.

Custom accelerators, energy-efficient designs, and vertically integrated AI stacks will play a larger role. However, demand for leading-edge AI chips is unlikely to weaken as long as model sizes and AI usage continue to grow.

For technology and innovation managers, AI chips should be viewed not as a commodity expense, but as a strategic capability investment.

Top 5 Frequently Asked Questions

Final Thoughts

AI chip sales performance reflects more than hardware demand—it reveals the trajectory of artificial intelligence itself. The data shows that AI progress is increasingly constrained by compute availability, making AI chips a foundational asset for innovation. Organizations that understand and plan around this reality will be best positioned to compete in an AI-driven economy.

Resources

- Epoch AI – AI Chip Sales Dataset

- Markets and Markets – AI Chipset Market Analysis

- Grand View Research – Artificial Intelligence Chipset Market

I am a huge enthusiast for Computers, AI, SEO-SEM, VFX, and Digital Audio-Graphics-Video. I’m a digital entrepreneur since 1992. Articles include AI assisted research. Always Keep Learning! Notice: All content is published for educational and entertainment purposes only. NOT LIFE, HEALTH, SURVIVAL, FINANCIAL, BUSINESS, LEGAL OR ANY OTHER ADVICE. Learn more about Mark Mayo